It’s common knowledge that one of the great advantages Baltimore has going for it is that living here is a bargain. And common knowledge is always right, right? Every year the City Paper’s reader’s poll lists ‘because it’s cheap.’ as the number one reason for living here. Articles are always appearing about DC people who were priced out and came an hour north to save money or about Joe Blow Handyman with his vacant shell and his sweat equity. But if common knowledge and feelgood stories in the Lifestyle section aren’t enough for you you can just look at the numbers and see that the average price to buy a home in Baltimore is a mere $107,000 according to Zillow data.

But wait a minute… There’s a problem with Zillow data, and with all data that treats the city like a monolithic whole. The problem is that Baltimore is not one city- there’s a White Baltimore and a Black Baltimore and they’re pretty far apart.

We wrote a very long and detailed post one year ago about racial issues and neighborhood choice. We invite you to go back and read it if you haven’t. It goes back to the city’s founding and touches on some of the serious systemic and historical racial injustices that shaped our neighborhoods into black and white, and some of the issues of gentrification that reshaped our white and formerly working class neighborhoods.

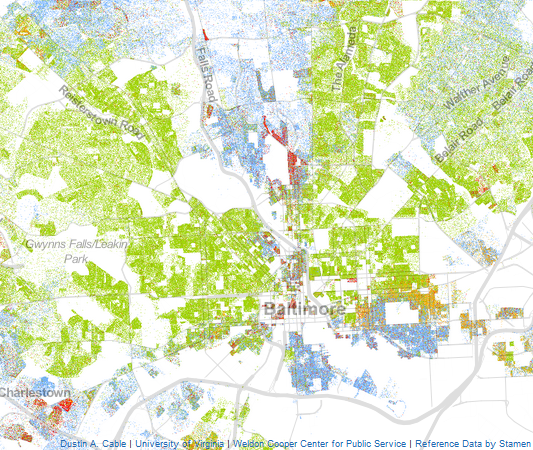

But the conclusion is unmistakeable and inescapable- on the whole black people and white people are not living together in Baltimore City and although we wish things were different there’s no reason to believe that our racially polarized neighborhoods will ever look much different in our lifetime. According to research, white people in the US are still overwhelmingly buying in white neighborhoods, and those who buck the trend are rewarded with lower rates of appreciation, if their homes appreciate at all. As a reminder, here’s what our city looks like by race (source).

The map clearly shows why many native Baltimoreans and longtime locals often refer to The White L, which is roughly the shape described by tracing a route from Mount Washington south between 83 and York Rd to Wells Street and then East to the city line below Baltimore Street. (It also sometimes contains Pigtown, depending on the particular discussion at hand.) Add in the Harford Road corridor and you’ve got the entirety of White Baltimore. (And yes we know there are white people south of Middle Branch but we’re not including that area for many reasons.)

We’ve never seen the phrase White L in print or on any website that publishes edited content, but we’ve heard it talked about (mostly by white people) for most of our life. If you’re a white person living in or visiting Baltimore there’s an odds-on chance that your entire civic/commercial/professional experience takes place in the White L/Harford Rd.

When white people talk about Baltimore being inexpensive to live in they are talking about White Baltimore. For the rest of this post we’ll be talking solely about White Baltimore. For many years Baltimore was a bargain- in white neighborhoods the cost of a modest rowhouse was in the middle five figures and stayed low while suburbanization ran rampant. In 2015 the White L has become significantly more expensive. It is no longer cheap to live in (white) Baltimore, as we’ll show you below.

Before we get started we’d like to get this out of the way: It’s foolish to compare Baltimore to New York City or Washington DC. New York is a major world city and a bona fide metropolis. As the capital, Washington enjoys such a large number of people connected to politics or employed by the federal government that it’s entirely unique. Both of these cities are a case apart and can’t be compared very well to any other city. Baltimore’s geographic proximity to them is merely an accident. In a subsequent post we’ll look at Baltimore’s affordability relative to other cities, but for now let’s look at what it actually costs to live in White Baltimore.

The Census quickfacts sheet on Baltimore lists the city’s median income at $41,385. NPR, also using census data, has that number at $39,866. But as they illustrate our cost of living is relatively higher than the national average and that $39,866 only goes as far as $34,606 does on average. In Maryland, life is 11.3% more expensive than average.

But those numbers encompass black, white and everyone else. We looked at data on 20 neighborhoods in the White L and determined that the median income for white people in Baltimore is about $53,849. (When you throw out the renter-heavy apartment-packed, very young neighborhoods of Downtown, Charles Village and Midtown the number climbs to $59,162. (Federal Hill and Canton are actually richer than Guilford now, all with median incomes in the $70,000’s)). [Edit: CNN is better at research than we are. When they broke it down by race and not by neighborhood they arrived at a figure of $60,550. So our guess was pretty good, especially considering Station North and Charles Village are somewhat diverse.]

So let’s use $53,849 as our barometer. It may or may not be accurate as the median income of white Baltimoreans but certainly it’s a good salary for one person and as a household income total it should allow for some flexibility and choice in housing. As you can see here, it’s enough to qualify as middle class, even in the richest state in the nation by household income which Maryland is. Most lenders and financial experts agree that households should not spend more than 28% of gross monthly income on housing. That gives our white home seeker earning $53,849 a monthly housing budget of $1256 or less.

He or she could spend that in rent, but as we pointed out in a previous post the average rent for a Baltimore apartment is $1285 a month. That means the average apartment price is not affordable to someone making over $50,000 a year, which is alarming and is proof enough on its own that Baltimore is no longer a cheap city.

We want to be clear that when we talk about housing options we’re particularly concerned with long-term adult residents. It’s all well and good for a college kid to live in a 400 sq ft studio or for emerging adults in their early twenties to share a house with roommates, but these are not viable options for bona fide adults. No one is going to willingly settle for 15-20 years in a tiny studio or spend their entire lives subject to the whims of a revolving cast of roommates. A 1 BR apartment with at least 700 sq ft is about the minimum that will attract long term tenants, and it’s not unusual for a long term resident to want or need two to three bedrooms. After all, if you ever want to have children they can’t spend their lives crashing on the couch.

Without making a very long and detailed study of the market we can’t possibly come up with an accurate price for a 1BR 700sf place or better limited to the White L and Harford Road. Our best guess is $1600/mo or more. But don’t take our word for it: browse the Zillow rental listings yourself and you’ll see that staying under $1256 for that type of apartment is very hard to do. And if you happen to make less than $54,000 and can afford less every month you’re pretty much SOL.

When you look at the 70+ projects recently completed or currently in development, only three of them are outside the White L: Sagamore Distillery is one and Johns Hopkins is another. The third is Poppleton, which is slated to take almost 20 years to complete and which suffered another setback recently when it was denied a TIF by the city. Of the dozens of other projects on that list, virtually all of them are going to be very expensive class A apartments. Not only is White Baltimore no longer cheap, it’s getting more expensive all the time.

For long-term adult residents it often makes much more sense to buy a home than to pay rent perpetually. If our buyer earning $54k wanted to buy in the city with its very high property taxes and insurance rates that would give them a budget of about $154,000. (This is working backwards from the same $1256 monthly payment and assuming they’ll qualify for a 4% rate and are making a down payment of only 4%, with 3.5% being the FHA minimum. Those are very liberal terms to assume. But it includes realistic tax rates and insurance costs, which lenders also consider when handing out loans.)

Let’s assume too that we want a house which is reasonably move-in ready. If we’re going to stay for 15-20 years we’re going to insist on two bedrooms, not one. It needn’t be a brand new rehab- we won’t worry at all about things like crappy wallpaper or ugly kitchens and bathrooms. But in our search let’s toss out anything that wouldn’t qualify for financing from most banks- this means that most as-is houses as well as many foreclosures. On our budget we don’t have the luxury of an additional renovation loan, so let’s also rule out houses that have been cut up into multiple units or any other listing that has obvious problems. Here are the search results.

At a $154k budget a buyer looking for a decent home is priced out of most white neighborhoods entirely. You’re not going south of the harbor, period. You’ll find nothing south of Eastern Ave on the east side and the best you’ll do between Eastern and Baltimore Street is a very small house, possibly in an alley. Who wants to go to the top of their budget to live in an alley?

In some white neighborhoods like the Charles Street corridor the housing stock consists of such large homes that our buyer is priced out automatically. Places like Charles Village and Bolton Hill are full of 6 bedroom mansions. Likewise you’re entirely priced out of areas like Roland Park, Mount Washington and Guilford/Homeland.

You might find something in your budget in Hamden or Remington, but looking in both neighborhoods today we’re seeing a combined total of six houses under $154k, mostly under 1000 sq feet. And get ’em while you can because as we’ve seen Hampden and Remington as well as the streets north of Patterson Park are already gentrified and those little shitbox houses won’t last at that price.

With our $154k budget a buyer’s only choices to get into a decent house of any size in white Baltimore is to go near the top of the budget on what’s bound to be a sketchy block in Pigtown, or a slightly less sketchy block all the way out in Greektown. You do start to see some decent options when you go out Harford Road or to the city’s eastern edge in neighborhoods like Bayview, Eastwood and Graceland Park, but if you’re going to live within about half a mile of the city line, you need to think long and hard about which side of it you want to be on, and most people will choose the side with the low taxes and decent schools.

Of course, there is the option to move outside the white L. We bought in Waverly, which is pretty damn close to the L geographically, but as we’ll see in a future post it can sometimes feel a world away. But as we saw above the choice we made is one white people are just not making in appreciable numbers and the few who do take that option can be penalized financially in the long term when it comes time to sell.

For white Baltimore gentrification isn’t happening- it has happened. It’s a done deal. If you want a decent house in white Baltimore a realistic budget is $300,000 which, using a 28% affordability formula and the same liberal assumptions as above means your payment is in the $2400/mo range, or exactly what the rent will be on a class A 2 BR apartment in one of the 70 shiny new projects being developed inside the White L. In order to reasonably afford that at a 28% threshold your household income needs to be at or above $100,000. That’s more than double the city’s median household income.

That’s why we bothered to list all of those development projects in one place. Taken together it should be immediately obvious how far developers and the city are bending over backward to build for and sell to white people and only white people. But not just any white people- rich outsiders and especially Millennials.

We’ve always had a great deal of inequality in our city, and as we look to the future it’s incredibly frustrating to see politicians with power and developers and investors with money not only repeating most of the past’s mistakes, but doing everything they can to see to it that inequality actually increases in the next generation.

There’s a lot of hype out there. City leaders and the developers they’re in bed with can host ribbon cuttings and grand openings all they like. They can point to this-or-that ‘market rate’ (read: $1285/mo.) project and talk at length about how tech and tech companies and Millennials are such a boon. The local news will always show up to cover it. The mayor can keep reminding us that 10,000 new families are coming. But 10,000 new families aren’t coming.

City population growth is flat. According to a recent article in the Sun the city lost about 600 residents in the last year and “The Maryland Department of Planning does not expect the city’s population to top 650,000 again until 2030 and projects the city’s growth rate will continue to lag other places in the state.” Indeed, Baltimore County is growing as the city stays flat. For every Millennial who comes, there’s a Gen X’er ready to leave.

The hype would have you believe that Millennials are entirely different from their parents, and while it’s true that survey after survey has them saying they want to live in cities, or want to live in this city, what people report to surveyors is not always an indicator of how they’ll behave. For white millennials it may be a blast to live in a house full of roommates near the harbor or a shabby-chic apartment in Mount Vernon, but once they get to be 30 or older and need to start making real long-term housing decisions and planning for families of their own those without combined incomes of $100,000 are going to realize very quickly that it’s incredibly difficult to build a life in the city. Likewise those with $300,000 or more to spend need to find a way to justify spending $500, $600, or $700 every month on property taxes alone, which is not uncommon in Baltimore’s gentrified neighborhoods.

One by one, each for their own reasons most white families will continue to decide- quietly and away from the media- that the time has come to leave Baltimore City, just as they always have. At the end of the day, Charm don’t come cheap.